Bankruptcy 101: A Guide By Tulsa Bankruptcy Attorneys

Bankruptcy 101: A Guide By Tulsa Bankruptcy Attorneys

Blog Article

Tulsa, Ok Bankruptcy Attorney: Strategies For Managing Bankruptcy Stress

Table of ContentsTulsa Bankruptcy Lawyer: Strategies For Reducing Credit Card Debt Post-bankruptcyBankruptcy Lawyer Tulsa: How To Handle Wage Garnishments And Bank LeviesBankruptcy Attorney Tulsa: The Impact Of Repossession On Your Bankruptcy CaseBankruptcy Lawyer Tulsa: Navigating Child Custody And Bankruptcy Issues

It can harm your credit rating for anywhere from 7-10 years and also be a barrier towards obtaining safety clearances. If you can not fix your troubles in much less than 5 years, bankruptcy is a sensible alternative. Lawyer fees for personal bankruptcy differ relying on which form you select, just how intricate your instance is and where you are geographically. Tulsa OK bankruptcy attorney.Various other personal bankruptcy prices include a filing charge ($338 for Phase 7; $313 for Phase 13); and also costs for credit rating counseling and economic monitoring training courses, which both price from $10 to $100.

You don't always need a lawyer when submitting individual insolvency on your own or "pro se," the term for representing on your own. If the instance is basic sufficient, you can file for personal bankruptcy without aid.

, the order removing financial debt. Plan on loading out considerable documents, collecting financial documents, investigating personal bankruptcy and exemption laws, and adhering to local regulations and also procedures.

Tulsa, Ok Bankruptcy Attorney: Understanding Bankruptcy And Alimony Payments

Here are 2 scenarios that always call for depiction., you'll likely want an attorney.

Filers do not have an automated right to disregard a Chapter 7 case. If you slip up, the personal bankruptcy court might toss out your case or sell properties you believed you could maintain. You could likewise face a insolvency lawsuit to determine whether a financial obligation shouldn't be released. If you lose, you'll be stuck paying the debt after insolvency.

Filers do not have an automated right to disregard a Chapter 7 case. If you slip up, the personal bankruptcy court might toss out your case or sell properties you believed you could maintain. You could likewise face a insolvency lawsuit to determine whether a financial obligation shouldn't be released. If you lose, you'll be stuck paying the debt after insolvency. You could wish to file Phase 13 to capture up on mortgage debts so you can keep your home. Or you might wish to get rid of your bank loan, "stuff down" or minimize a vehicle loan, or pay back a financial debt that will not disappear in bankruptcy over time, such as back tax obligations or assistance financial obligations.

You could wish to file Phase 13 to capture up on mortgage debts so you can keep your home. Or you might wish to get rid of your bank loan, "stuff down" or minimize a vehicle loan, or pay back a financial debt that will not disappear in bankruptcy over time, such as back tax obligations or assistance financial obligations.Many individuals realize the legal fees needed to work with a personal bankruptcy lawyer are quite affordable once they understand exactly how they can gain from a personal bankruptcy attorney's aid. In most cases, a bankruptcy attorney can quickly recognize concerns you might not spot. Some individuals apply for bankruptcy due to the fact that they don't understand their alternatives.

Bankruptcy Attorney Tulsa: A Guide To Chapter 7 And Chapter 13

For the majority of consumers, the sensible choices are Chapter 7 and also Chapter 13 personal bankruptcy. bankruptcy lawyer Tulsa. Phase 7 could be the means to go if you have low income and no possessions.

Here are typical problems bankruptcy lawyers can stop. Personal bankruptcy is form-driven. Many self-represented bankruptcy debtors don't submit all of the called for bankruptcy records, and their situation obtains dismissed.

You don't shed every little thing in personal bankruptcy, yet keeping property relies on recognizing exactly how property exemptions job. If you stand to shed useful home like your residence, car, or other home you care about, an attorney could be well worth the cash. In Chapters 7 as well as 13, personal bankruptcy filers should receive credit bankruptcy lawyer Tulsa score counseling from an approved service provider before filing for insolvency and finish a financial monitoring program on trial issues a discharge.

Not all insolvency situations continue smoothly, and also other, a lot more complicated problems can emerge. Many self-represented filers: don't recognize the value of activities and also opponent activities can't properly defend against an action looking for to deny discharge, and have a challenging time complying with complicated bankruptcy treatments.

Tulsa Bankruptcy Lawyer: Understanding The Medical Bankruptcy Process

Or another thing might chop up. The bottom line is that an attorney is important when you discover on your own on the getting end of an this article activity or claim. If you choose to submit for insolvency on your very own, learn what services are readily available in your district for pro se filers.

, from brochures describing low-priced or complimentary solutions to thorough info concerning insolvency. Look for a personal bankruptcy publication that highlights situations needing an attorney.

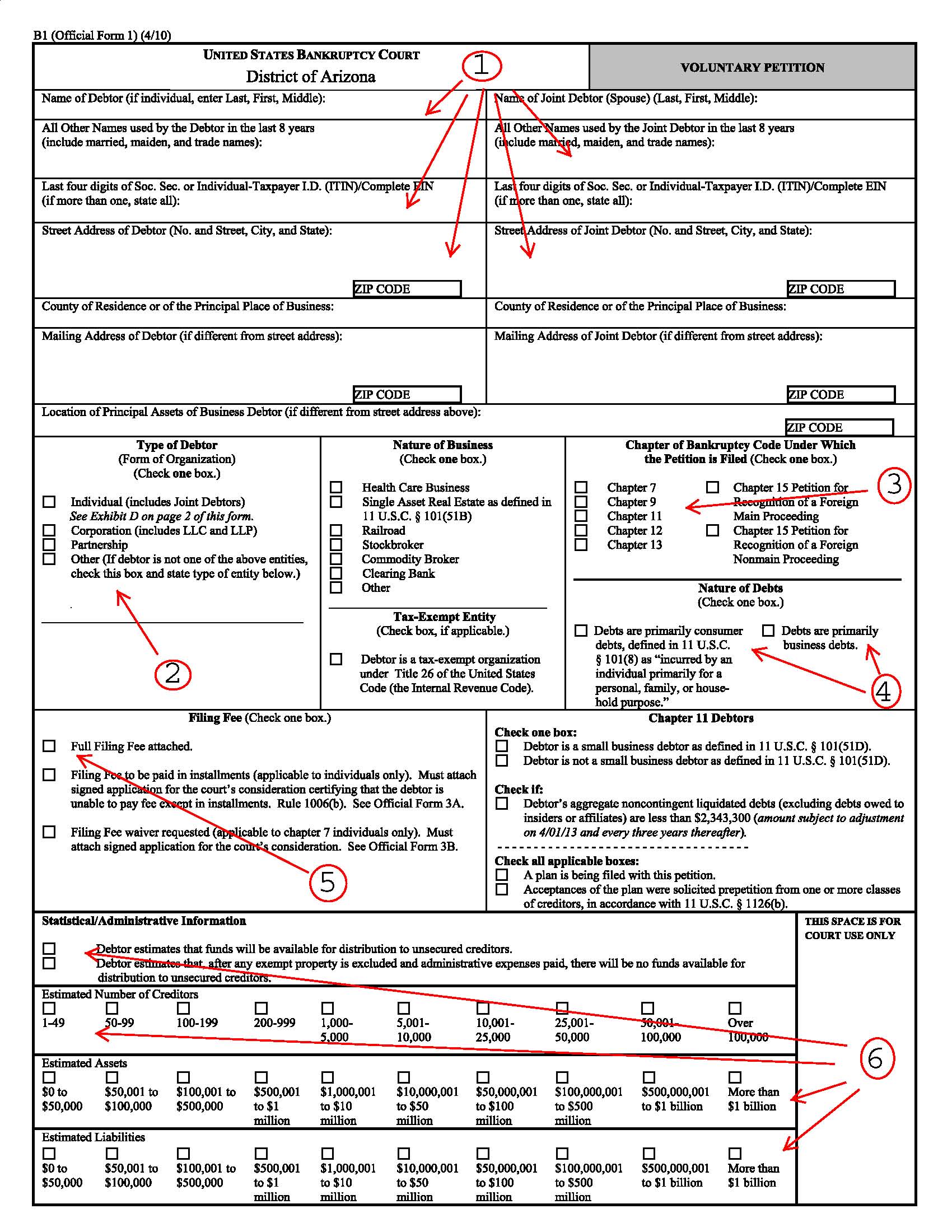

You should precisely fill in many forms, study the law, and go to hearings. If you understand insolvency law however would certainly like assistance finishing the forms (the standard bankruptcy request is around 50 web pages long), you could think about hiring an insolvency application preparer. An insolvency petition preparer is anybody or business, apart from a lawyer or someone that benefits an attorney, that bills a charge to prepare bankruptcy records.

Due to the fact that bankruptcy application preparers are not attorneys, they can not provide legal guidance or represent you in insolvency court. Especially, they can not: tell you which type of bankruptcy to submit tell you not to provide particular debts tell you not to detail certain properties, or tell you what residential or commercial property to excluded.

Due to the fact that bankruptcy application preparers are not attorneys, they can not provide legal guidance or represent you in insolvency court. Especially, they can not: tell you which type of bankruptcy to submit tell you not to provide particular debts tell you not to detail certain properties, or tell you what residential or commercial property to excluded.Report this page